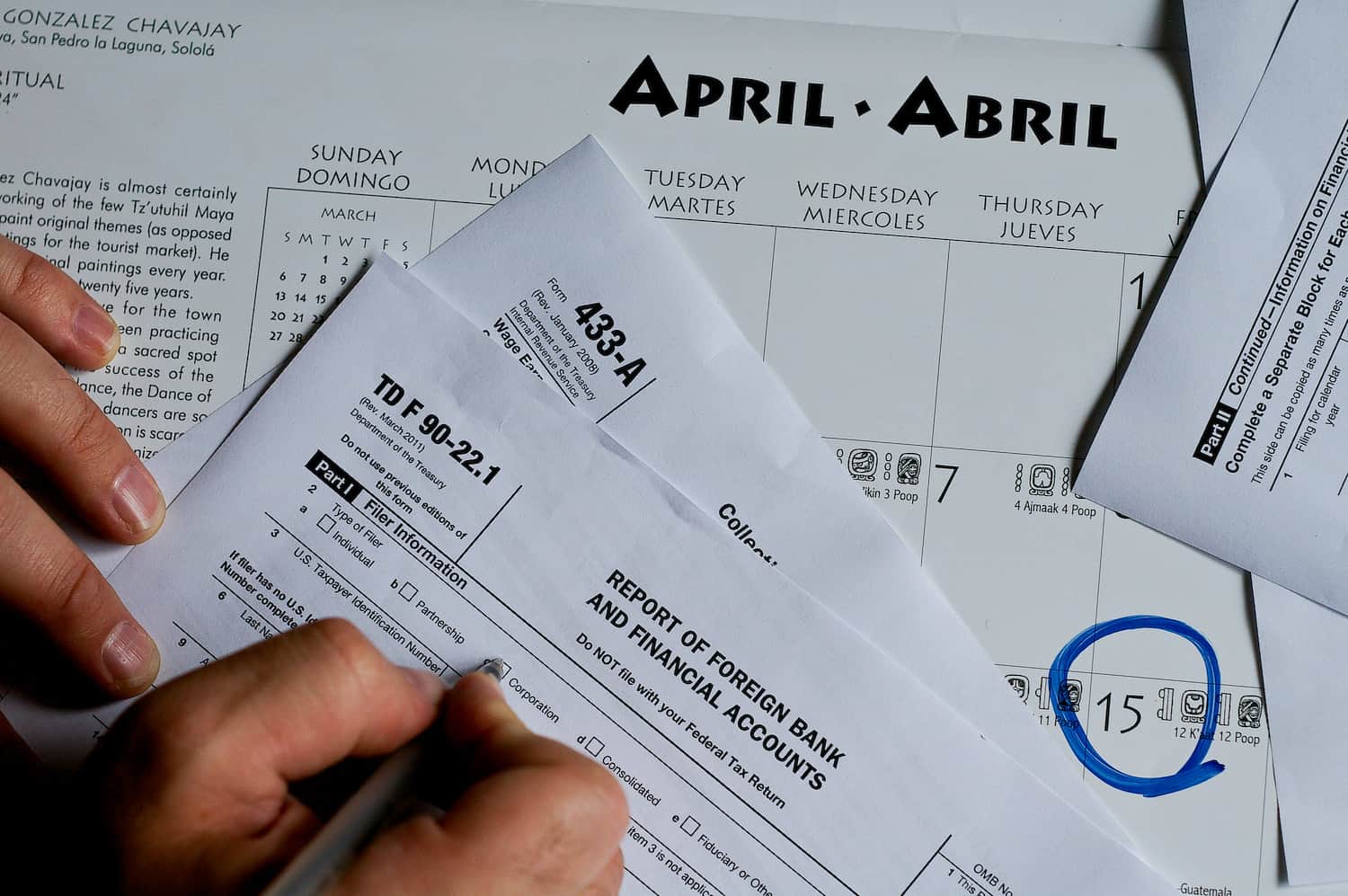

April and June have long passed, yet more than a few U.S. expats in Costa Rica still haven’t filed their 2013 tax returns.

Figuring out how to catch up can be confusing, to say the least. Some decide to blow it off entirely. But even if you live and work only in Costa Rica, if you’re a U.S. citizen you still must file tax returns in the United States, regardless of where your income is generated. So what’s the first step in getting caught up if you miss the deadlines?

We turned to Mitchell Bardack, an accountant at Costa Rican-American Chamber of Commerce member Asesores Fiscales Corporativos (AFC), for help in answering some of the most basic questions.

“You can file at any time, but you’ll have to pay penalties, interest and late fees,” Bardack warned. “Anyone can have returns filed now, and if they haven’t filed, they should get it done.”

He explained that any U.S. citizen living outside of the U.S. is allowed an automatic two-month extension to file a return and pay any taxes owed without formally requesting that extension. The automatic extension expires on June 15 of each year. If you’re going to miss that deadline, you can request an additional extension through Oct. 15 by filing Form 4868, titled “Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.” But any tax payments made after June 15 will be subject to interest and penalties.

“The [October] extension is only to stop the late fee penalties and interest running on any tax liability that’s due for the 2013 tax year,” Bardack said. “But if you file now and you owe taxes, what’s going to happen is the IRS will calculate it out and say, ‘You should have paid us this amount by Jan. 31. …’ The No. 1 thing is to get everything filed.”

So what about those who haven’t filed for several years?

“My recommendation is to get everything caught up. But there are a lot of issues. There are more things that need to be included with the returns. And as a U.S. citizen, you have to report everything. You are taxed on your worldwide income, so if you have any foreign companies, you have to report your ownership in those foreign companies. If you have bank accounts, you have to report all of your balances in those accounts,” Bardack explained.

“To get everything caught up, this type of process can be long and drawn out. If you have a foreign company [outside the U.S.], you have to have accounting for it, and the accounting has to be done under U.S. rules. You can’t report it under Costa Rican rules,” he said.

It gets more complicated: “You then have to look at ownership and beneficial ownership. If I am a U.S. citizen and I’m married to a Costa Rican, but my company is in the name of my wife, well, that doesn’t matter, I have beneficial ownership. So there’s a more complex web of rules that have to be looked at in order to see who reports what and how everything is reported. And it’s all based on just holding that little blue passport,” he said.

A U.S. expat who is an employee of a Costa Rican company normally would need to provide documentation of gross salary for all unreported years, travel to and from the U.S. during that same time period, and bank account statements. For consulting jobs in the U.S., most companies provide 1099 forms that must be included. Any investments or holdings in the U.S. also need to be documented.

“Let’s say someone comes down here from a U.S. company and they are on assignment. If they are on a U.S. payroll, then the U.S. entity would provide them a W2 form, so they have to report everything that’s reported on their W2,” he said.

Tax forms can be downloaded from the IRS website, and many can be filled out in a PDF format. However, according to Bardack, those forms are basic and don’t calculate taxes and credits, and there are numerous attachments that must be included. It’s still possible to file taxes overseas without help. But don’t feel bad if you need assistance – you’re definitely not alone.

And if you forgot to file but believe the IRS owes you a refund, said Bardack: “Don’t expect interest.”

For those who are struggling, AMCHAM recommends the following companies:

- Asesores Fiscales Corporativos (AFC). Phone: 2204-8080.

- ARA-Law Abogados-Bufete A. Rodriguez y Asociados S.A. Phone: 2291-8844.

- Ernst & Young S.A. Phone: 2208-9800.

On the Web, see: http://www.irs.gov/Individuals/International-Taxpayers/U.S.-Citizens-and-Resident-Aliens-Abroad

Got an expat tax story to share? Find a good source for help? Let us know in the comments section below.